FIRM LEVEL

3 steps towards i-score computation

Click on the 3-step diagram below to see more:

-

We compute the i-score for each firm by scaling the ESG rating by the divergence factor generated in step 2.

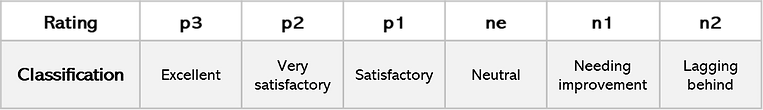

Classification scheme of ESG recognition

The ESG sentiment indicator: Sustainability focused

Theoretically, the sentiment score ranges between -1 (negative) and +1 (positive), which reflects how professionals perceive the ESG information from the media coverage in a given period. Our ESG sentiment indicator is derived from a commercial-grade AI-driven NLP engine.

Keywords for sustainability sentiment are:

Net-Zero emissions, greenhouse gas emissions, positive environmental events, waste dumping, habitat destruction, environmental noncompliance, executive-incentives, misstatement, misleading-labeling, executive scandal, executive firing, executive absence, fraud, corruption, money laundering, insider trading, embezzlement, investment, labor-conditions-noncompliance, industrial accidents, legal-issues, privacy, gender-pay-gap, product fault, and product side effects.

Classification Scheme of Sustainability Sentiment Level

(01.2023-12.2023)

PORTFOLIO LEVEL

Rating scheme by i-score: the 4-petal rating

100% of the invested value of the composite stocks in the portfolio rank the upper 50% of industry peers

75% of the invested value of the composite stocks in the portfolio rank the upper 50% of industry peers

50% of the invested value of the composite stocks in the portfolio rank the upper 50% of industry peers

25% of the invested value of the composite stocks in the portfolio rank the upper 50% of industry peers

0% of the invested value of the composite stocks in the portfolio rank the upper 50% of industry peers